Climate Change Scenarios: Difference between revisions

| (6 intermediate revisions by the same user not shown) | |||

| Line 2: | Line 2: | ||

Due to the complex interplay of climatic and socioeconomic systems, it is impossible to accurately predict the future, including the frequency, severity, impacts of climate hazards and the transition pathways. To address this inherent uncertainty in modeling climate-related macroeconomic and financial risks, TCFD recommends the adoption of '''scenario analysis''' to explore a range of plausible outcomes of climate change’s impacts on the financial system<ref name=":0">Taskforce on Climate-Related Financial Disclosures (June 2017). “Recommendations of the Taskforce on Climate-related Financial Disclosures: Final Report.” Available at: <nowiki>https://assets.bbhub.io/company/sites/60/2021/10/FINAL-2017-TCFD-Report.pdf</nowiki></ref>. | Due to the complex interplay of climatic and socioeconomic systems, it is impossible to accurately predict the future, including the frequency, severity, impacts of climate hazards and the transition pathways. To address this inherent uncertainty in modeling climate-related macroeconomic and financial risks, TCFD recommends the adoption of '''scenario analysis''' to explore a range of plausible outcomes of climate change’s impacts on the financial system<ref name=":0">Taskforce on Climate-Related Financial Disclosures (June 2017). “Recommendations of the Taskforce on Climate-related Financial Disclosures: Final Report.” Available at: <nowiki>https://assets.bbhub.io/company/sites/60/2021/10/FINAL-2017-TCFD-Report.pdf</nowiki></ref>. | ||

The selection of climate change scenarios determines the range of impacts expected. Various organizations, including the TCFD<ref name=":0" />, IPCC<ref name=":2">IPCC, 2023: ''Climate Change 2023: Synthesis Report.'' Contribution of Working Groups I, II and III to the Sixth Assessment Report of the Intergovernmental Panel on Climate Change [Core Writing Team, H. Lee and J. Romero (eds.)]. IPCC, Geneva, Switzerland, pp. 35-115, doi: 10.59327/IPCC/AR6-9789291691647.</ref>, NGFS<ref>NGFS | The selection of climate change scenarios determines the range of impacts expected. Various organizations, including the TCFD<ref name=":0" />, IPCC<ref name=":2">IPCC, 2023: ''Climate Change 2023: Synthesis Report.'' Contribution of Working Groups I, II and III to the Sixth Assessment Report of the Intergovernmental Panel on Climate Change [Core Writing Team, H. Lee and J. Romero (eds.)]. IPCC, Geneva, Switzerland, pp. 35-115, doi: 10.59327/IPCC/AR6-9789291691647.</ref>, NGFS<ref>NGFS (2020). Guide to climate scenario analysis for central banks and supervisors. Available at: https://www.ngfs.net/sites/default/files/medias/documents/ngfs_guide_scenario_analysis_final.pdf</ref>, and third-party vendors, provide climate scenarios that outline different pathways, from low-carbon transitions to high-emissions futures. Most of them are built around a '''global temperature target''' or '''emission pathways''' and follow four '''common pathways''': (i) ambitious Paris Agreement-aligned action; (ii) delayed Paris Agreement-aligned action; (iii) current policy commitments; and (iv) business as usual.<ref name=":1">UNEP FI (2023). The Climate Risk Landscape. Available at: https://www.unepfi.org/themes/climate-change/2023-climate-risk-landscape/</ref> | ||

In this section, we focus on the IPCC scenarios<ref name=":2" /> and the NGFS scenarios <ref name=":3">NGFS (2023). NGFS Scenarios for central banks and supervisors. Available at: | In this section, we focus on the IPCC scenarios<ref name=":2" /> and the NGFS scenarios <ref name=":3">NGFS (2023). NGFS Scenarios for central banks and supervisors. Available at: https://www.ngfs.net/sites/default/files/medias/documents/ngfs_climate_scenarios_for_central_banks_and_supervisors_phase_iv.pdf</ref>. The IPCC scenarios are the benchmarks for generating future climate projection data. NGFS scenarios are frequently used by central banks and financial supervisors<ref name=":4">World Bank. ''Double Trouble? Assessing Climate Physical and Transition Risks for the Moroccan Banking Sector (English).'' Washington, D.C. : World Bank Group. http://documents.worldbank.org/curated/en/099040924013528667/P175074139948c00a1ae591466b51bbb4d6</ref><ref name=":5">Alogoskoufis, Spyros, et al. ''ECB economy-wide climate stress test: Methodology and results''. No. 281. ECB Occasional Paper, 2021.</ref>. The NGFS portal provides a comprehensive suite of models, including data, scripts, tools, and detailed documentation. For users seeking more information, the NGFS technical documentation<ref>NGFS (2023). NGFS Climate Scenario Database Technical Documentation V4.2. Available at: https://www.ngfs.net/sites/default/files/media/2024/01/16/ngfs_scenarios_technical_documentation_phase_iv_2023.pdf </ref> and presentation<ref name=":3" /> offer further insights, including comparisons with IEA and IPCC scenarios. | ||

== IPCC Scenarios == | == IPCC Scenarios == | ||

| Line 71: | Line 71: | ||

== NGFS Scenarios == | == NGFS Scenarios == | ||

A shared understanding of how climate change impacts the financial sector is essential for coordinated global action. The NGFS, in collaboration with climate scientists and economists, developed a suite of climate scenarios for central banks and supervisors to support this. These scenarios provide a common reference framework for analyzing how climate-related physical risks and transition risks might evolve in different futures and how these changes would impact on the economy and financial system. They also serve as a starting point for researchers and specialists who wish to enhance the scenarios by adding finer details or incorporating additional feedback effects. | |||

These NGFS scenarios are now widely used across both the public and private sectors to assess climate risks. For example, central banks like the European Central Bank (ECB) have employed them for economy-wide climate stress tests, as has the Moroccan central bank<ref name=":5" /><ref name=":4" />. | |||

Each NGFS scenario explores a different set of assumptions for how climate policy, emissions, temperatures and physical risk impacts evolve. Specifically, | |||

* '''Orderly scenarios''' assume climate policies are introduced early and become gradually more stringent. Both physical and transition risks are relatively subdued. | |||

* '''Disorderly scenarios''' explore higher transition risks due to policies being delayed or divergent across countries and sectors. | |||

* '''Hot house world scenarios''' assume that some climate policies are implemented in some jurisdictions, but globally efforts are insufficient to halt significant global warming. The scenarios result in severe physical risk including irreversible impacts like sea-level rise. | |||

* '''Too-little-too-late scenarios''' assume that a late and uncoordinated transition fails to limit physical risks. | |||

[[File:NGFS_scenarios.png|thumb|center|600px|alt=NGFS Scenarios(Source: NGFS(2023))|<big>(NGFS Scenarios. Source: [https://www.ngfs.net/ngfs-scenarios-portal/ NGFS Scenarios Portal])</big>]] | |||

=== [https://www.ngfs.net/ngfs-scenarios-portal/use/ NGFS Scenarios Portal] === | |||

The [https://www.ngfs.net/ngfs-scenarios-portal/use/ NGFS Climate Scenarios Portal] provides a comprehensive suite of data and tools to analyze transition risks, physical risks, and their broader economic and financial impacts. This was created for central banks and financial supervisors but has been reported useful for private sectors. This resource is widely recognized and used by key regulatory bodies, including the Basel Committee on Banking Supervision<ref>Basel Committee on Banking Supervision (BCBS), 2022. Principles for the effective management and supervision of climate‐related financial risks.</ref> and European Central Bank<ref>Alogoskoufis, Spyros, et al. ''ECB economy-wide climate stress test: Methodology and results''. No. 281. ECB Occasional Paper, 2021.</ref>. Figure 1 below shows an overview of the scenario analysis process using the NGFS portal.[[File:scenario_analysis_process.png|thumb|center|700px|alt=Transmission Channels|Overview of the Scenario Analysis Process (Source: NGFS (2020)<ref name=":0" />)]] | |||

== Other Scenarios == | == Other Scenarios == | ||

| Line 92: | Line 97: | ||

| rowspan="5" |IEA World Energy Outlook (WEO) | | rowspan="5" |IEA World Energy Outlook (WEO) | ||

[updated | [updated annually] | ||

| colspan="1" |NZE2050 (Net-zero emissions by 2050) | | colspan="1" |NZE2050 (Net-zero emissions by 2050) | ||

|Energy | |Energy | ||

| Line 98: | Line 103: | ||

|Outlines the technology, policies, and behaviour change necessary to bring about net-zero emissions by 2050 and includes key energy related UN SDGs. | |Outlines the technology, policies, and behaviour change necessary to bring about net-zero emissions by 2050 and includes key energy related UN SDGs. | ||

|- | |- | ||

|SDS 2020 ( | |SDS 2020 (Sustainable Development Scenario) | ||

|Energy | |Energy | ||

|1.8°C (66%) 1.5°C (50%) | |1.8°C (66%) 1.5°C (50%) | ||

|Considers social (SDG) and climate goals | |Considers social (SDG) and climate goals | ||

|- | |- | ||

|STEPS (Stated | |STEPS (Stated Policies Scenario) | ||

|Energy | |Energy | ||

|Around~2.5°C | |Around~2.5°C | ||

| Line 140: | Line 145: | ||

|- | |- | ||

|IPCC | |IPCC | ||

|RCP ( | |RCP (Representative Concentration Pathways) | ||

|All sectors | |All sectors | ||

|1.0°C (RCP 2.6) 1.8°C (RCP 4.5) 2.2°C (RCP 6.0) 3.7°C (RCP 8.5) | |1.0°C (RCP 2.6) 1.8°C (RCP 4.5) 2.2°C (RCP 6.0) 3.7°C (RCP 8.5) | ||

| Line 165: | Line 170: | ||

(mid-term estimates 2041–2060) | (mid-term estimates 2041–2060) | ||

|Assesses results from the CMIP6 | |Assesses results from the CMIP6 project in 5 SSP scenarios, with a broader range of GHG, land-use, air-pollutant futures than AR5, and accounts for solar activity and background forcing from volcanoes | ||

|- | |- | ||

| colspan="1" rowspan="3" |NGFS | | colspan="1" rowspan="3" |NGFS | ||

| Line 199: | Line 204: | ||

Sectoral decarbonisation pathways and targets broken into Scope 1, 2, and 3 for industry sectors defined by CIGS standard | Sectoral decarbonisation pathways and targets broken into Scope 1, 2, and 3 for industry sectors defined by CIGS standard | ||

|- | |- | ||

| colspan="1" rowspan="3" |UNPRI | | colspan="1" rowspan="3" |UNPRI Inevitable Policy Response (IPR) | ||

|Forecast Policy Scenario | |Forecast Policy Scenario | ||

|All sectors | |All sectors | ||

Latest revision as of 18:00, 15 November 2024

Overview

Due to the complex interplay of climatic and socioeconomic systems, it is impossible to accurately predict the future, including the frequency, severity, impacts of climate hazards and the transition pathways. To address this inherent uncertainty in modeling climate-related macroeconomic and financial risks, TCFD recommends the adoption of scenario analysis to explore a range of plausible outcomes of climate change’s impacts on the financial system[1].

The selection of climate change scenarios determines the range of impacts expected. Various organizations, including the TCFD[1], IPCC[2], NGFS[3], and third-party vendors, provide climate scenarios that outline different pathways, from low-carbon transitions to high-emissions futures. Most of them are built around a global temperature target or emission pathways and follow four common pathways: (i) ambitious Paris Agreement-aligned action; (ii) delayed Paris Agreement-aligned action; (iii) current policy commitments; and (iv) business as usual.[4]

In this section, we focus on the IPCC scenarios[2] and the NGFS scenarios [5]. The IPCC scenarios are the benchmarks for generating future climate projection data. NGFS scenarios are frequently used by central banks and financial supervisors[6][7]. The NGFS portal provides a comprehensive suite of models, including data, scripts, tools, and detailed documentation. For users seeking more information, the NGFS technical documentation[8] and presentation[5] offer further insights, including comparisons with IEA and IPCC scenarios.

IPCC Scenarios

| Near term, 2021-2040 | Mid-term, 2041-2060 | Long term, 2081-2100 | |||||

| Scenario | Description | Best estimate (°C) | Very likely range (°C) | Best estimate (°C) | Very likely range (°C) | Best estimate (°C) | Very likely range (°C) |

| SSP1-1.9 | Based on SSP1 with low climate change mitigation and adaptation chal- lenges that lead to a future pathway with a radiative forcing of 1.9 W/ m2 in the year 2100. The SSP1–1.9 scenario fills a gap at the very low end of the range of plausible future forcing pathways, due to interest in informing a possible goal of limiting global mean warming to 1.5°C above pre-industrial levels based on the Paris COP21 agreement. | 1.5 | 1.2 to 1.7 | 1.6 | 1.2 to 2.0 | 1.4 | 1.0 to 1.8 |

| SSP1-2.6 | Based on SSP1 with low climate change mitigation and adaptation chal- lenges that lead to a radiative forcing of 2.6 W/ m2 in the year 2100. The SSP1–2.6 scenario represents the low end of plausible future forcing path- ways. SSP1–2.6 depicts a “best case” future from a sustainability perspective. | 1.5 | 1.2 to 1.8 | 1.7 | 1.3 to 2.2 | 1.8 | 1.3 to 2.4 |

| SSP2-4.5 | Based on SSP2 with intermediate climate change mitigation and adaptation challenges that lead to a radiative forcing of 4.5 W/m2 in the year 2100. The SSP2–4.5 scenario represents the medium part of plausible future forcing pathways. SSP2–4.5 is comparable to the CMIP5 experiment RCP4.5. | 1.5 | 1.2 to 1.8 | 2.0 | 1.6 to 2.5 | 2.7 | 2.1 to 3.5 |

| SSP3-7.0 | Based on SSP3 in which climate change mitigation and adaptation chal- lenges are high, which leads to a radiative forcing of 7.0 W/m2 in the year 2100. The SSP3–7.0 scenario represents the medium to high end of plausible future forcing pathways. SSP3–7.0 fills a gap in the CMIP5 forcing pathways that is particularly important because it represents a forcing level common to several (unmitigated) SSP baseline pathways. | 1.5 | 1.2 to 1.8 | 2.1 | 1.7 to 2.6 | 3.6 | 2.8 to 4.6 |

| SSP5-8.5 | SSP5–8.5 is based on SSP5 in which climate change mitigation challenges dominate that lead to a radiative forcing of 8.5 W/ m2 in the year 2100. The SSP5–8.5 scenario represents the high end of plausible future forcing path- ways. SSP5–8.5 is comparable to the CMIP5 experiment RCP8.5. | 1.5 | 1.3 to 1.9 | 2.4 | 1.9 to 3.0 | 4.4 | 3.3 to 5.7 |

NGFS Scenarios

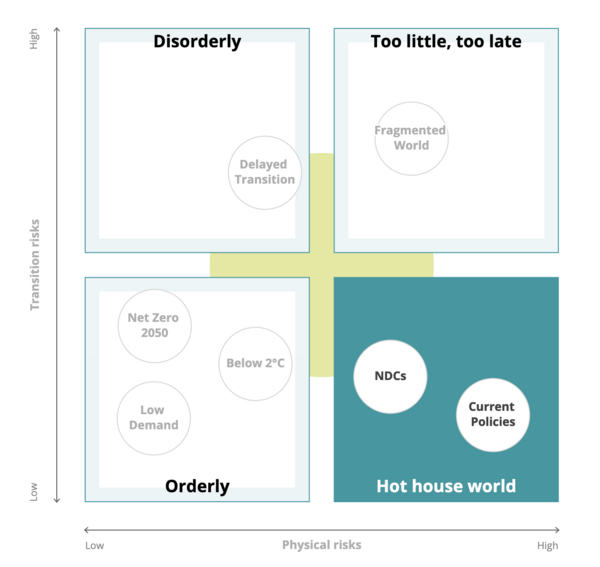

A shared understanding of how climate change impacts the financial sector is essential for coordinated global action. The NGFS, in collaboration with climate scientists and economists, developed a suite of climate scenarios for central banks and supervisors to support this. These scenarios provide a common reference framework for analyzing how climate-related physical risks and transition risks might evolve in different futures and how these changes would impact on the economy and financial system. They also serve as a starting point for researchers and specialists who wish to enhance the scenarios by adding finer details or incorporating additional feedback effects.

These NGFS scenarios are now widely used across both the public and private sectors to assess climate risks. For example, central banks like the European Central Bank (ECB) have employed them for economy-wide climate stress tests, as has the Moroccan central bank[7][6].

Each NGFS scenario explores a different set of assumptions for how climate policy, emissions, temperatures and physical risk impacts evolve. Specifically,

- Orderly scenarios assume climate policies are introduced early and become gradually more stringent. Both physical and transition risks are relatively subdued.

- Disorderly scenarios explore higher transition risks due to policies being delayed or divergent across countries and sectors.

- Hot house world scenarios assume that some climate policies are implemented in some jurisdictions, but globally efforts are insufficient to halt significant global warming. The scenarios result in severe physical risk including irreversible impacts like sea-level rise.

- Too-little-too-late scenarios assume that a late and uncoordinated transition fails to limit physical risks.

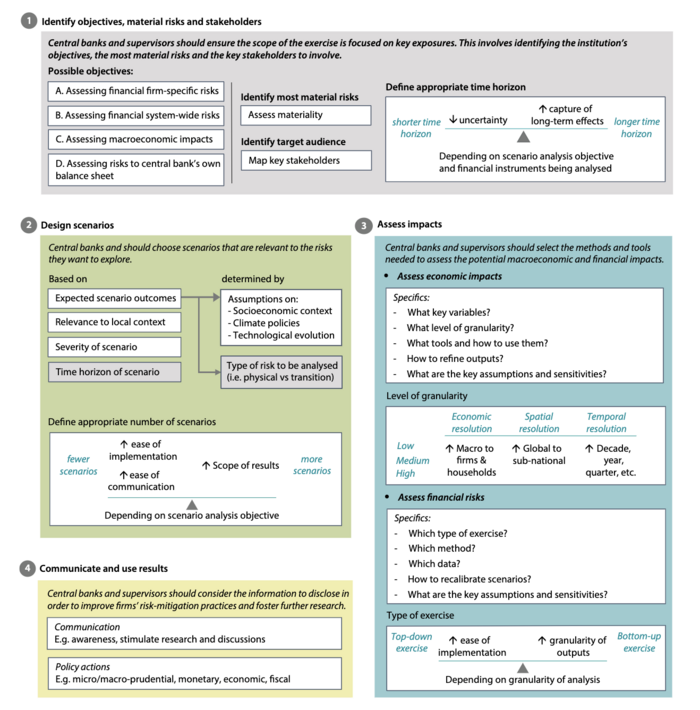

NGFS Scenarios Portal

The NGFS Climate Scenarios Portal provides a comprehensive suite of data and tools to analyze transition risks, physical risks, and their broader economic and financial impacts. This was created for central banks and financial supervisors but has been reported useful for private sectors. This resource is widely recognized and used by key regulatory bodies, including the Basel Committee on Banking Supervision[9] and European Central Bank[10]. Figure 1 below shows an overview of the scenario analysis process using the NGFS portal.

Other Scenarios

Table below listed the most commonly used scenarios[4].

| Scenario Provider | Name | Sector | Est. implied temp. rise | Basis |

| IEA World Energy Outlook (WEO)

[updated annually] |

NZE2050 (Net-zero emissions by 2050) | Energy | 1.5°C | Outlines the technology, policies, and behaviour change necessary to bring about net-zero emissions by 2050 and includes key energy related UN SDGs. |

| SDS 2020 (Sustainable Development Scenario) | Energy | 1.8°C (66%) 1.5°C (50%) | Considers social (SDG) and climate goals | |

| STEPS (Stated Policies Scenario) | Energy | Around~2.5°C | Accounts for stated policies and measures in place or under develop- ment in each sector (replaces the New Policies Scenario, NPS) | |

| APS (Announced Pledges Scenario) | All sectors | 1.7°C | Assumes that governments will meet fully and on-time all climate-related commitments made, and includes related pledges made by the private sector and NGOs; does not achieve outcomes targeted in SDS 2020. | |

| Delayed Recovery Scenario (DRS) | Energy | <2.7°C | STEPS with a delayed recovery from pandemic | |

| IEA Energy Technology

Perspectives (ETP) [2020 release feeds into SDS scenario] |

2DS (2 Degrees Scenario) | Energy | 2°C | Rapid decarbonisation pathway in line with the Paris Agreement |

| B2DS (Beyond 2 Degrees Scenario) | Energy | 1.75°C | Includes the extent of clean energy technologies if pushed to their practical limits, in line with ambitious aspirations of the Paris Agreement | |

| RTS (Reference Technology

Scenario) |

Energy | 2.75°C | Takes into account existing energy and climate-related pledges, including NDCs. | |

| IPCC | RCP (Representative Concentration Pathways) | All sectors | 1.0°C (RCP 2.6) 1.8°C (RCP 4.5) 2.2°C (RCP 6.0) 3.7°C (RCP 8.5) | RCPs outline pathways according to different levels of radiative forcing in the CMIP5 |

| IPCC | SR15 | All sectors | 1.5°C | Set of P1–4 pathways to meet 1.5°C target, building on RCP 1.9 |

| IPCC | AR6 | All sectors | 1.6°C (SSP1– 1.9)

1.7°C (SSP1– 2.6) 2.0°C (SSP2– 4.5) 2.1°C (SSP3– 7.0) 2.4°C (SSP5– 8.5) (mid-term estimates 2041–2060) |

Assesses results from the CMIP6 project in 5 SSP scenarios, with a broader range of GHG, land-use, air-pollutant futures than AR5, and accounts for solar activity and background forcing from volcanoes |

| NGFS | Orderly (NZ 2050 and Below 2°C) | All sectors | 1.4°C (NZ 2050)

1.6°C (Below 2°C) |

Transition Risks include policy reactions, technology change, CO2 removal, and regional policy variation. Both orderly and disorderly have alternate scenarios with limited or full CDR |

| Disorderly (Diver- gent NZ and Delayed Transition) | All sectors | 1.4°C (Diver- gent NZ)

1.6°C (Delayed Transition) |

Higher transition risk than for Orderly scenario | |

| Hot-house World (NDCs and Current Policies) | All sectors | 2.6°C (NDCs)

3°C+ (Current Policies) |

Only current policies implemented, not NDCs, i.e. equivalent to IEA STEPS | |

| OECM | One Climate Earth Model (OECM 1.0)

OECM 2.0 (2022) |

All sectors | 1.5°C | 1.5°C trajectory in 10 world regions without the continued use of fossil fuels

Sectoral decarbonisation pathways and targets broken into Scope 1, 2, and 3 for industry sectors defined by CIGS standard |

| UNPRI Inevitable Policy Response (IPR) | Forecast Policy Scenario | All sectors | 1.8°C | Based on the anticipated policy response to meeting the Paris Agree- ment and subsequent impact on emissions reduction and temperature outcomes |

| Forecast Policy Scenario + Nature | All sectors | Currently no agreed upon target for biodi- versity levels analogous to 1.5°C | Focused on climate policy trends and their interaction with land use, including nature-related policy action. | |

| Required Policy Scenario | All sectors | 1.5°C | Current assessment of future policy developments needed to deliver 1.5°C outcome |

References

- ↑ 1.0 1.1 1.2 Taskforce on Climate-Related Financial Disclosures (June 2017). “Recommendations of the Taskforce on Climate-related Financial Disclosures: Final Report.” Available at: https://assets.bbhub.io/company/sites/60/2021/10/FINAL-2017-TCFD-Report.pdf

- ↑ 2.0 2.1 IPCC, 2023: Climate Change 2023: Synthesis Report. Contribution of Working Groups I, II and III to the Sixth Assessment Report of the Intergovernmental Panel on Climate Change [Core Writing Team, H. Lee and J. Romero (eds.)]. IPCC, Geneva, Switzerland, pp. 35-115, doi: 10.59327/IPCC/AR6-9789291691647.

- ↑ NGFS (2020). Guide to climate scenario analysis for central banks and supervisors. Available at: https://www.ngfs.net/sites/default/files/medias/documents/ngfs_guide_scenario_analysis_final.pdf

- ↑ 4.0 4.1 UNEP FI (2023). The Climate Risk Landscape. Available at: https://www.unepfi.org/themes/climate-change/2023-climate-risk-landscape/

- ↑ 5.0 5.1 NGFS (2023). NGFS Scenarios for central banks and supervisors. Available at: https://www.ngfs.net/sites/default/files/medias/documents/ngfs_climate_scenarios_for_central_banks_and_supervisors_phase_iv.pdf

- ↑ 6.0 6.1 World Bank. Double Trouble? Assessing Climate Physical and Transition Risks for the Moroccan Banking Sector (English). Washington, D.C. : World Bank Group. http://documents.worldbank.org/curated/en/099040924013528667/P175074139948c00a1ae591466b51bbb4d6

- ↑ 7.0 7.1 Alogoskoufis, Spyros, et al. ECB economy-wide climate stress test: Methodology and results. No. 281. ECB Occasional Paper, 2021.

- ↑ NGFS (2023). NGFS Climate Scenario Database Technical Documentation V4.2. Available at: https://www.ngfs.net/sites/default/files/media/2024/01/16/ngfs_scenarios_technical_documentation_phase_iv_2023.pdf

- ↑ Basel Committee on Banking Supervision (BCBS), 2022. Principles for the effective management and supervision of climate‐related financial risks.

- ↑ Alogoskoufis, Spyros, et al. ECB economy-wide climate stress test: Methodology and results. No. 281. ECB Occasional Paper, 2021.