Main Page: Difference between revisions

No edit summary |

|||

| (72 intermediate revisions by 2 users not shown) | |||

| Line 1: | Line 1: | ||

__NOTOC__ | |||

<div style="display: flex; justify-content: space-between; margin-bottom: 10px;"> | <div style="display: flex; justify-content: space-between; margin-bottom: 10px;"> | ||

<div style="width: 95%; padding-right: 20px;"> | <div style="width: 95%; padding-right: 20px;"> | ||

<div class="MainPageBG" style="border: 1px solid #d7d7d7; padding: 20px; background-color: #32006f;"> | <div class="MainPageBG" style="border: 1px solid #d7d7d7; padding: 20px; background-color: #32006f;"> | ||

<center><p style="color: #ffffff; font-size: 25px"> Welcome to | <center><p style="color: #ffffff; font-size: 25px"> Welcome to the Climate Risk Wiki! </p> | ||

<p style="color: #e1dbea; font-size: 16px">the | <p style="color: #e1dbea; font-size: 16px">"On a mission to make the best climate risk data, analysis, and tools available for all"</p> | ||

</div> | </div> | ||

</div> | </div> | ||

</div> | </div> | ||

<!-- Note --> | |||

<!-- Basic structure below > | |||

-- open whole page set up | |||

-- open Left column | |||

<open mini page of left column 1> | |||

<close mini page 1> | |||

<open mini page of left column 2> | |||

<close mini page 2> | |||

-- <close left column> | |||

-- Right column... | |||

-- close whole page | |||

--> | |||

<div style="display: flex; justify-content: space-between; margin-bottom: 20px;"> | <div style="display: flex; justify-content: space-between; margin-bottom: 20px;"> | ||

| Line 14: | Line 29: | ||

<!-- About --> | <!-- About --> | ||

<div class="MainPageBG" style="border: 1px solid #d7d7d7; padding: 10px; background-color: #f9f9f9;"> | <div class="MainPageBG" style="border: 1px solid #d7d7d7; padding: 10px; background-color: #f9f9f9;"> | ||

<h2>UW Climate Risk Lab</h2 | <h2 style="font-family: 'Helvetica', Arial, sans-serif; | ||

font-weight: bold; font-size: 21px">UW Climate Risk Lab</h2> | |||

<p>The UW Climate Risk Lab (CRL) is a multidisciplinary research and innovation center based at the [https://foster.uw.edu/ University of Washington Foster School of Business] in the Department of Finance & Business Economics. Established in 2022, it advances data and technology solutions to issues in climate-related financial risk for corporate and government decision-makers. [https://foster.uw.edu/faculty-research/directory/phillip-bruner/ Phillip Bruner], co-founder of the CRL, currently serves as its Executive Director. ( | <p>The UW Climate Risk Lab (CRL) is a multidisciplinary research and innovation center based at the [https://foster.uw.edu/ University of Washington Foster School of Business] in the Department of Finance & Business Economics. Established in 2022, it advances data and technology solutions to issues in climate-related financial risk for corporate and government decision-makers. [https://foster.uw.edu/faculty-research/directory/phillip-bruner/ Phillip Bruner], co-founder of the CRL, currently serves as its Executive Director. <p>The CRL brings together academics and professionals in climate finance, risk management, business | ||

analytics, data engineering, computer science, atmospheric sciences, supply chains management, | |||

information systems and AI. It collaborates with several initiatives within the [https://www.washington.edu/ University of Washington (UW)], which include the [https://foster.uw.edu/centers/buerk-ctr-entrepreneurship/ Buerk Center for Entrepreneurship], [https://www.cei.washington.edu/ Clean Energy Institute], [https://foster.uw.edu/centers/creative-destruction-lab/ Creative Destruction Lab], [https://escience.washington.edu/ eSciences Institute] and [https://uil.be.uw.edu/ Urban Infrastructure Lab]. Its external partners include: the [https://nicholasinstitute.duke.edu/issues/energy-data-analytics Duke Energy Data Analytics Lab], the [https://pnwmac.org/ Pacific Northwest Mission Accelerator Center], and [https://maritimeblue.org/ Washington Maritime Blue].</p> | |||

<div class="mw-collapsible mw-collapsed" data-expandtext="Read more" data-collapsetext="Read less"> | |||

<h3>History</h3> | |||

<p>The CRL originated in 2022 with a grant from the Office of UW President [https://en.wikipedia.org/wiki/Ana_Mari_Cauce Ana Marie Cauce] made to the Foster School of Business, Department of Finance & Business Economics. The idea was then developed by a team led by [https://foster.uw.edu/faculty-research/directory/phillip-bruner/ Phillip Bruner], UW Professor of Sustainable Finance, [https://impaxam.com/about/team/charlie-donovan/ Charlie Donovan], Senior Economic Advisor at [https://en.wikipedia.org/wiki/Impax_Asset_Management_Group Impax Asset Management], Sam Shugart, New Product & Services Market Analyst at Puget Sound Energy and Simon Park, Harvard graduate and Fellow of the [https://en.wikipedia.org/wiki/Evans_School_of_Public_Policy_and_Governance UW Evans School of Public Policy]. | |||

=== '''Editorial Board''' === | |||

The Editorial Board is responsible for maintaining the accuracy, quality, and relevance of all content. They guide contributors, oversee new additions, and ensure the wiki remains an up-to-date and reliable resource for climate-related financial risk analysis, following the [[Climate Risk Lab Wiki Editorial Guidelines|editorial guidelines]]. | |||

:[https://foster.uw.edu/faculty-research/directory/phillip-bruner/ Dr. Phillip Bruner] Professor of Sustainable Finance and CRL Executive Director | |||

:[https://www.linkedin.com/in/xiaojuanliu-uw/ Dr. Xiaojuan Liu] Climate Data Scientist at CRL | |||

:[https://www.linkedin.com/in/annakruglova/ Dr. Anna Fitzgerald] Postdoctoral Researcher at National Association of Insurance Commissioners (NAIC) | |||

:[https://www.ceres.org/people/jaclyn-de-medicci-bruneau Jaclyn de Medicci Bruneau] Director of Insurance at Ceres | |||

=== '''Steering Committee''' === | |||

<p>The CRL Steering Committee is currently made up of the following members:</p> | |||

:[https://foster.uw.edu/faculty-research/directory/phillip-bruner/ Phillip Bruner], Professor of Sustainable Finance and CRL Executive Director | |||

:[https://www.leobix.us/ Léonard Boussioux], Assistant Professor of Information Systems and Operations Management | |||

:[https://impaxam.com/about/team/charlie-donovan/ Charlie Donovan], Senior Economic Advisor at [https://en.wikipedia.org/wiki/Impax_Asset_Management_Group Impax Asset Management] and CRL Leadership Council Chair | |||

:[https://foster.uw.edu/faculty-research/directory/emer-dooley/ Emer Dooley], Artie Buerk Faculty Fellow and Site Lead at Creative Destruction Lab | |||

:[https://www.atmos.washington.edu/~durrand/ Dale Durran], Professor of Atmospheric Sciences and Adjunct Professor of Applied Mathematics | |||

:[https://globalhealth.washington.edu/faculty/kristie-ebi Kristie Ebi], Professor of Global Health and Environmental and Occupational Health Sciences and Founder of the [https://www.washington.edu/research/research-centers/center-health-global-environment-change/ UW Center for Health and the Global Environment] | |||

:[https://about.me/sarajones#! Sara Jones], Director of the Masters of Supply Chain Management and Master of Science in Business Analytics | |||

:[https://www.cei.washington.edu/people/daniel-t-schwartz/ Dan Schwartz], Boeing-Sutter Professor of Chemical Engineering and Founding Director of the [https://www.cei.washington.edu/ Clean Energy Institute] | |||

:[https://urbdp.be.uw.edu/people/jan-whittington/ Jan Whittington], Associate Professor of the Department of Urban Design and Planning and Founding Director of the [https://uil.be.uw.edu/ Urban Infrastructure Lab] | |||

</div> | </div> | ||

<div style="clear: both;"></div> | |||

</div> | |||

<div class="MainPageBG" style="border: 1px solid #d7d7d7; padding: 10px; background-color: #f9f9f9;"> | |||

<h2 style="font-family: 'Helvetica', Arial, sans-serif; | |||

font-weight: bold; font-size: 21px">License Information</h2> | |||

<p>This website’s content is licensed under a [https://creativecommons.org/licenses/by/4.0/ Creative Commons Attribution 4.0 International License].</p> | |||

'''You are free to: ''' | |||

* Share — copy and redistribute the material in any medium or format for any purpose, even commercially. | |||

* Adapt — remix, transform, and build upon the material for any purpose, even commercially. | |||

:The licensor cannot revoke these freedoms as long as you follow the license terms. | |||

'''Under the following terms:''' | |||

* Attribution — You must give appropriate credit, provide a link to the license, and indicate if changes were made. You may do so in any reasonable manner, but not in any way that suggests the licensor endorses you or your use. | |||

* No additional restrictions — You may not apply legal terms or technological measures that legally restrict others from doing anything the license permits. | |||

<div class="mw-collapsible mw-collapsed" data-expandtext="Read more" data-collapsetext="Read less"> | |||

'''Notices:''' | |||

* You do not have to comply with the license for elements of the material in the public domain or where your use is permitted by an applicable exception or limitation. | |||

* No warranties are given. The license may not give you all of the permissions necessary for your intended use. For example, other rights such as publicity, privacy, or moral rights may limit how you use the material. | |||

Read the full license [https://creativecommons.org/licenses/by/4.0/ here]. | |||

</div> | |||

<div style="clear: both;"></div> | |||

</div> | </div> | ||

</div> | </div> | ||

<!-- Right Column --> | |||

<div style="width: 50%;"> | <div style="width: 50%;"> | ||

<!-- Did you know Section --> | <!-- Did you know Section --> | ||

<div class="MainPageBG" style="border: 1px solid #d7d7d7; padding: 10px; background-color: #f9f9f9;"> | <div class="MainPageBG" style="border: 1px solid #d7d7d7; padding: 10px; background-color: #f9f9f9;"> | ||

= | <h2 style="font-family: 'Helvetica', Arial, sans-serif; | ||

Climate change is | font-weight: bold; font-size: 21px">Climate-related Financial Risk</h2> | ||

<div> | |||

<p>[[wikipedia:Climate_change|Climate change]] is already impacting the Earth dramatically<ref>IPCC, 2023: ''Climate Change 2023: Synthesis Report.'' Contribution of Working Groups I, II and III to the Sixth Assessment Report of the Intergovernmental Panel on Climate Change [Core Writing Team, H. Lee and J. Romero (eds.)]. IPCC, Geneva, Switzerland, pp. 35-115, doi: 10.59327/IPCC/AR6-9789291691647.</ref>, and the continued rise in greenhouse gas emissions will cause further warming of the planet, leading to significant socio-economic consequences. These impacts pose substantial risks to businesses, particularly those in vulnerable industries, affecting their credit profiles, share prices, and overall financial stability.</p> | |||

While the general understanding that climate change poses risks is widely accepted, it is not enough for lenders, investors, or regulators to act effectively without a clearer definition of the specific financial risks. These risks need to be quantified in terms of their scope, timing, and probability of occurrence. Identifying and understanding climate-related financial risks early on is critical, as they can lead to reduced asset utilization or valuation, decreased income, and lower profit margins. These financial impacts can translate into increased credit risk, influencing lenders' decisions and reshaping the financial profiles of affected industries.<ref>Imperial College Business School Center for Climate Finance & Investment (February 2022). “What is Climate Risk? A Field Guide for Investors, Lenders, and Regulators.” Available at: https://imperialcollegelondon.app.box.com/s/te5eahz3x47q93vufwwu3ntmf5rxecxs</ref> | |||

<div class="mw-collapsible mw-collapsed" data-expandtext="Read more" data-collapsetext="Read less"> | |||

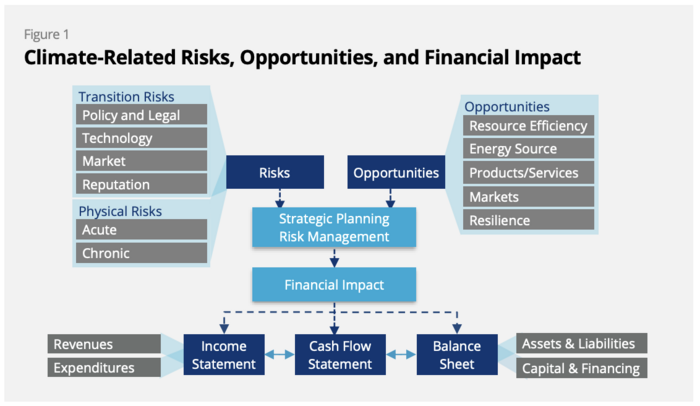

The Taskforce on Climate-Related Financial Disclosures (TCFD) <ref>Taskforce on Climate-Related Financial Disclosures (June 2017). “Recommendations of the Taskforce on Climate-related Financial Disclosures: Final Report.” Available at: https://assets.bbhub.io/company/sites/60/2021/10/FINAL-2017-TCFD-Report.pdf</ref> divided climate-related financial risks into two major categories: | |||

* '''Physical Risks''': risks related to the physical impacts of climate change. [<nowiki/>[[Physical Risk|Read more]]] | |||

* '''Transition Risks''': risks related to the transition to a lower-carbon economy. [<nowiki/>[[Transition risk|Read more]]] | |||

[[File:Climate_related_risks.png|thumb|center|700px|Climate-Related Risks, Opportunities, and Financial Impact]] | |||

''Source: [https://assets.bbhub.io/company/sites/60/2021/10/FINAL-2017-TCFD-Report.pdf Recommendations of the Task Force on Climate-related Financial Disclosures]'' | |||

</p> | |||

</div> | |||

</div> | |||

<div style="clear: both;"></div> | |||

</div> | |||

<div class="MainPageBG" style="border: 1px solid #d7d7d7; padding: 10px; background-color: #f9f9f9;"> | |||

<h2 style="font-family: 'Helvetica', Arial, sans-serif; | |||

font-weight: bold; font-size: 21px">Call for Collaboration</h2> | |||

The goal of this platform is to '''continuously gather, update, and share high-quality data, analysis and tools''' to support climate-related financial risk education and decision-making. | |||

We invite you to join us in this effort by contributing your expertise, knowledge, datasets, and tools. We welcome participation from experts, organizations, and communities engaged in climate-related financial risk analysis. | |||

By sharing your resources, you will: | |||

* Help enhance our collective understanding of climate-related financial risks. | |||

* Enable broader access to cutting-edge climate-related financial risk models and forecasts. | |||

* Join a network of professionals who support our mission to “make the best climate-related financial risk data, analysis and tools available for all.” | |||

If you are interested in contributing to our work please choose one of the following options: | |||

* '''Submit''' your data directly using [https://forms.gle/Unc1S5oaAQPb3Wkm9 this form]; | |||

* Request to '''join''' the [https://www.climateriskwiki.uw.edu/index.php?title=Special:RequestAccount Climate Risk Lab Wiki] as an approved contributor; | |||

* '''Contact''' us at [mailto:xjliu@uw.edu xjliu@uw.edu] | |||

Together, we can work toward a future where climate risk is accounted for in all organizational decision-making worldwide! | |||

</div> | |||

</div> | |||

</div> | |||

<!-- Place the references tag outside of the div --> | |||

<div style="clear: both; width: 100%;"> | |||

<div style="display: flex; justify-content: space-between; margin-bottom: 10px;"> | |||

<div style="width: 95%; padding-right: 20px;"> | |||

== References == | |||

<references /> | |||

</div> | |||

</div> | |||

</div> | |||

Latest revision as of 03:52, 8 November 2024

Welcome to the Climate Risk Wiki!

"On a mission to make the best climate risk data, analysis, and tools available for all"

UW Climate Risk Lab

The UW Climate Risk Lab (CRL) is a multidisciplinary research and innovation center based at the University of Washington Foster School of Business in the Department of Finance & Business Economics. Established in 2022, it advances data and technology solutions to issues in climate-related financial risk for corporate and government decision-makers. Phillip Bruner, co-founder of the CRL, currently serves as its Executive Director.

The CRL brings together academics and professionals in climate finance, risk management, business analytics, data engineering, computer science, atmospheric sciences, supply chains management, information systems and AI. It collaborates with several initiatives within the University of Washington (UW), which include the Buerk Center for Entrepreneurship, Clean Energy Institute, Creative Destruction Lab, eSciences Institute and Urban Infrastructure Lab. Its external partners include: the Duke Energy Data Analytics Lab, the Pacific Northwest Mission Accelerator Center, and Washington Maritime Blue.

History

The CRL originated in 2022 with a grant from the Office of UW President Ana Marie Cauce made to the Foster School of Business, Department of Finance & Business Economics. The idea was then developed by a team led by Phillip Bruner, UW Professor of Sustainable Finance, Charlie Donovan, Senior Economic Advisor at Impax Asset Management, Sam Shugart, New Product & Services Market Analyst at Puget Sound Energy and Simon Park, Harvard graduate and Fellow of the UW Evans School of Public Policy.

Editorial Board

The Editorial Board is responsible for maintaining the accuracy, quality, and relevance of all content. They guide contributors, oversee new additions, and ensure the wiki remains an up-to-date and reliable resource for climate-related financial risk analysis, following the editorial guidelines.

- Dr. Phillip Bruner Professor of Sustainable Finance and CRL Executive Director

- Dr. Xiaojuan Liu Climate Data Scientist at CRL

- Dr. Anna Fitzgerald Postdoctoral Researcher at National Association of Insurance Commissioners (NAIC)

- Jaclyn de Medicci Bruneau Director of Insurance at Ceres

Steering Committee

The CRL Steering Committee is currently made up of the following members:

- Phillip Bruner, Professor of Sustainable Finance and CRL Executive Director

- Léonard Boussioux, Assistant Professor of Information Systems and Operations Management

- Charlie Donovan, Senior Economic Advisor at Impax Asset Management and CRL Leadership Council Chair

- Emer Dooley, Artie Buerk Faculty Fellow and Site Lead at Creative Destruction Lab

- Dale Durran, Professor of Atmospheric Sciences and Adjunct Professor of Applied Mathematics

- Kristie Ebi, Professor of Global Health and Environmental and Occupational Health Sciences and Founder of the UW Center for Health and the Global Environment

- Sara Jones, Director of the Masters of Supply Chain Management and Master of Science in Business Analytics

- Dan Schwartz, Boeing-Sutter Professor of Chemical Engineering and Founding Director of the Clean Energy Institute

- Jan Whittington, Associate Professor of the Department of Urban Design and Planning and Founding Director of the Urban Infrastructure Lab

License Information

This website’s content is licensed under a Creative Commons Attribution 4.0 International License.

You are free to:

- Share — copy and redistribute the material in any medium or format for any purpose, even commercially.

- Adapt — remix, transform, and build upon the material for any purpose, even commercially.

- The licensor cannot revoke these freedoms as long as you follow the license terms.

Under the following terms:

- Attribution — You must give appropriate credit, provide a link to the license, and indicate if changes were made. You may do so in any reasonable manner, but not in any way that suggests the licensor endorses you or your use.

- No additional restrictions — You may not apply legal terms or technological measures that legally restrict others from doing anything the license permits.

Notices:

- You do not have to comply with the license for elements of the material in the public domain or where your use is permitted by an applicable exception or limitation.

- No warranties are given. The license may not give you all of the permissions necessary for your intended use. For example, other rights such as publicity, privacy, or moral rights may limit how you use the material.

Read the full license here.

Climate change is already impacting the Earth dramatically[1], and the continued rise in greenhouse gas emissions will cause further warming of the planet, leading to significant socio-economic consequences. These impacts pose substantial risks to businesses, particularly those in vulnerable industries, affecting their credit profiles, share prices, and overall financial stability.

While the general understanding that climate change poses risks is widely accepted, it is not enough for lenders, investors, or regulators to act effectively without a clearer definition of the specific financial risks. These risks need to be quantified in terms of their scope, timing, and probability of occurrence. Identifying and understanding climate-related financial risks early on is critical, as they can lead to reduced asset utilization or valuation, decreased income, and lower profit margins. These financial impacts can translate into increased credit risk, influencing lenders' decisions and reshaping the financial profiles of affected industries.[2]

The Taskforce on Climate-Related Financial Disclosures (TCFD) [3] divided climate-related financial risks into two major categories:

- Physical Risks: risks related to the physical impacts of climate change. [Read more]

- Transition Risks: risks related to the transition to a lower-carbon economy. [Read more]

Source: Recommendations of the Task Force on Climate-related Financial Disclosures

Call for Collaboration

The goal of this platform is to continuously gather, update, and share high-quality data, analysis and tools to support climate-related financial risk education and decision-making.

We invite you to join us in this effort by contributing your expertise, knowledge, datasets, and tools. We welcome participation from experts, organizations, and communities engaged in climate-related financial risk analysis.

By sharing your resources, you will:

- Help enhance our collective understanding of climate-related financial risks.

- Enable broader access to cutting-edge climate-related financial risk models and forecasts.

- Join a network of professionals who support our mission to “make the best climate-related financial risk data, analysis and tools available for all.”

If you are interested in contributing to our work please choose one of the following options:

- Submit your data directly using this form;

- Request to join the Climate Risk Lab Wiki as an approved contributor;

- Contact us at xjliu@uw.edu

Together, we can work toward a future where climate risk is accounted for in all organizational decision-making worldwide!

References

- ↑ IPCC, 2023: Climate Change 2023: Synthesis Report. Contribution of Working Groups I, II and III to the Sixth Assessment Report of the Intergovernmental Panel on Climate Change [Core Writing Team, H. Lee and J. Romero (eds.)]. IPCC, Geneva, Switzerland, pp. 35-115, doi: 10.59327/IPCC/AR6-9789291691647.

- ↑ Imperial College Business School Center for Climate Finance & Investment (February 2022). “What is Climate Risk? A Field Guide for Investors, Lenders, and Regulators.” Available at: https://imperialcollegelondon.app.box.com/s/te5eahz3x47q93vufwwu3ntmf5rxecxs

- ↑ Taskforce on Climate-Related Financial Disclosures (June 2017). “Recommendations of the Taskforce on Climate-related Financial Disclosures: Final Report.” Available at: https://assets.bbhub.io/company/sites/60/2021/10/FINAL-2017-TCFD-Report.pdf