Physical Risk: Assessment Methodology: Difference between revisions

Created page with "Climate change impacts financial systems both directly and indirectly (ref. this report by the World Bank; Fig. XX). '''Direct damages''' refer to immediate to short-term physical destruction, including destruction of housing, critical infrastructure, and means of production which results in direct financial loss. Indirectly, climate hazards affect the financial sector via impacting the macroeconomic environment (see section 2.1 Transmission channels). index.php?title..." |

No edit summary |

||

| (One intermediate revision by the same user not shown) | |||

| Line 1: | Line 1: | ||

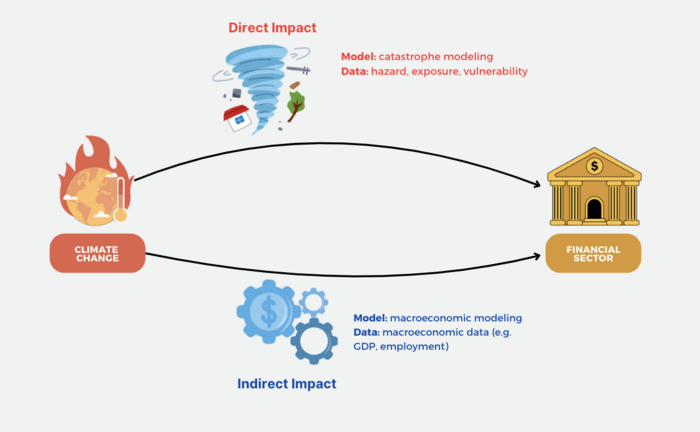

Climate change impacts financial systems both directly and indirectly ( | Climate change impacts financial systems both directly and indirectly (Figure 1).<ref>Bavandi,Antoine; Berrais, Dorra; Dolk,Michaela Mei; Mahul,Olivier. | ||

''Physical Climate Risk Assessment : Practical Lessons for the Development of Climate Scenarios with Extreme Weather Events from Emerging Markets and Developing Economies - Technical Document (English).'' Washington, D.C. : World Bank Group. <nowiki>http://documents.worldbank.org/curated/en/099657511082325958/IDU0004b1eec0d7f304e7c0967305183f75f92a2</nowiki></ref> '''Direct damages''' refer to immediate to short-term physical destruction, including destruction of housing, critical infrastructure, and means of production which results in direct financial loss. '''Indirectly''', climate hazards affect the financial sector via impacting the macroeconomic environment (see [[Transmission Channels: Climate Risk to Financial Risk|Transmission channels]]). | |||

[[File:schematic_acute_risk.png|thumb|center|700px|alt=Physical Risk|Acute Risk]] | |||

'''Direct damages''', primarily at the asset level, are typically assessed using a traditional risk assessment framework where risk is defined as the product of '''hazard''', '''exposure''', and '''vulnerability''' (ref. IPCC report). This is often done through a '''catastrophe modeling''' approach which integrates climate hazard information with exposure and vulnerability metrics to estimate the financial cost of physical damage (or “losses”) to a geographically specific portfolio of physical assets. | |||

A '''catastrophe model''' typically includes three main components: a '''hazard module''', which assesses the extent and intensity of climate hazards; a '''vulnerability module''', which relates hazard to physical damage; and a '''financial module''' that translates physical damage to financial losses.<ref>Note that variations in catastrophe modeling exist. For example, in the "''[https://documents.worldbank.org/en/publication/documents-reports/documentdetail/099040924013528667/p175074139948c00a1ae591466b51bbb4d6 Double Trouble? Assessing Climate Physical and Transition Risks for the Moroccan Banking Sector]''" by the World Bank, financial module is omitted and an exposure module is included in the catastrophe model. In the "''[https://www.cisl.cam.ac.uk/resources/sustainable-finance-publications/physical-risk-framework-understanding-the-impact-of-climate-change-on-real-estate-lending-and-investment-portfolios Physical risk framework: Understanding the impact of climate change on real estate lending and investment portfolios]''"report by the Cambridge Institute for Sustainability Leadership, however, exposure is treated as an input. </ref><ref>World Bank. ''Double Trouble? Assessing Climate Physical and Transition Risks for the Moroccan Banking Sector (English).'' Washington, D.C. : World Bank Group. <nowiki>http://documents.worldbank.org/curated/en/099040924013528667/P175074139948c00a1ae591466b51bbb4d6</nowiki></ref> <ref>Cambridge Institute for Sustainability Leadership (CISL). (2019, February). ''Physical risk framework: Understanding the impacts of climate change on real estate lending and investment portfolios.'' Cambridge, UK: Cambridge Institute for Sustainability Leadership.</ref>The key output of a catastrophe model is the distribution of possible losses, expressed in financial terms, to the portfolio. [[Climate Change Scenarios|Scenario analysis]], often implemented using Monte Carlo simulations as seen in models like [https://climada-python.readthedocs.io/en/stable/tutorial/1_main_climada.html CLIMADA], is also usually embedded in catastrophe models where the events are modeled thousands of times with slight modifications each time to reflect the overall likely distribution of losses due to inherent uncertainty in those estimates. See the data section for lists of open-source catastrophe models. | |||

''' | The '''indirect impacts''' are estimated by '''macroeconomic models''' which capture how the direct damages propagate and interact with other sectoral and macroeconomic variables over time. Macro-economic information, such as GDP, employment, household consumption, and trade flow, and the country specific socioeconomic data is needed to xx. Examples of models are listed in Table 1 (add table here). Page 29 of this also gives advice on the choice of macroeconomic models. | ||

Latest revision as of 19:24, 15 October 2024

Climate change impacts financial systems both directly and indirectly (Figure 1).[1] Direct damages refer to immediate to short-term physical destruction, including destruction of housing, critical infrastructure, and means of production which results in direct financial loss. Indirectly, climate hazards affect the financial sector via impacting the macroeconomic environment (see Transmission channels).

Direct damages, primarily at the asset level, are typically assessed using a traditional risk assessment framework where risk is defined as the product of hazard, exposure, and vulnerability (ref. IPCC report). This is often done through a catastrophe modeling approach which integrates climate hazard information with exposure and vulnerability metrics to estimate the financial cost of physical damage (or “losses”) to a geographically specific portfolio of physical assets.

A catastrophe model typically includes three main components: a hazard module, which assesses the extent and intensity of climate hazards; a vulnerability module, which relates hazard to physical damage; and a financial module that translates physical damage to financial losses.[2][3] [4]The key output of a catastrophe model is the distribution of possible losses, expressed in financial terms, to the portfolio. Scenario analysis, often implemented using Monte Carlo simulations as seen in models like CLIMADA, is also usually embedded in catastrophe models where the events are modeled thousands of times with slight modifications each time to reflect the overall likely distribution of losses due to inherent uncertainty in those estimates. See the data section for lists of open-source catastrophe models.

The indirect impacts are estimated by macroeconomic models which capture how the direct damages propagate and interact with other sectoral and macroeconomic variables over time. Macro-economic information, such as GDP, employment, household consumption, and trade flow, and the country specific socioeconomic data is needed to xx. Examples of models are listed in Table 1 (add table here). Page 29 of this also gives advice on the choice of macroeconomic models.

- ↑ Bavandi,Antoine; Berrais, Dorra; Dolk,Michaela Mei; Mahul,Olivier. Physical Climate Risk Assessment : Practical Lessons for the Development of Climate Scenarios with Extreme Weather Events from Emerging Markets and Developing Economies - Technical Document (English). Washington, D.C. : World Bank Group. http://documents.worldbank.org/curated/en/099657511082325958/IDU0004b1eec0d7f304e7c0967305183f75f92a2

- ↑ Note that variations in catastrophe modeling exist. For example, in the "Double Trouble? Assessing Climate Physical and Transition Risks for the Moroccan Banking Sector" by the World Bank, financial module is omitted and an exposure module is included in the catastrophe model. In the "Physical risk framework: Understanding the impact of climate change on real estate lending and investment portfolios"report by the Cambridge Institute for Sustainability Leadership, however, exposure is treated as an input.

- ↑ World Bank. Double Trouble? Assessing Climate Physical and Transition Risks for the Moroccan Banking Sector (English). Washington, D.C. : World Bank Group. http://documents.worldbank.org/curated/en/099040924013528667/P175074139948c00a1ae591466b51bbb4d6

- ↑ Cambridge Institute for Sustainability Leadership (CISL). (2019, February). Physical risk framework: Understanding the impacts of climate change on real estate lending and investment portfolios. Cambridge, UK: Cambridge Institute for Sustainability Leadership.