Transmission Channels: Climate Risk to Financial Risk: Difference between revisions

No edit summary |

mNo edit summary |

||

| Line 1: | Line 1: | ||

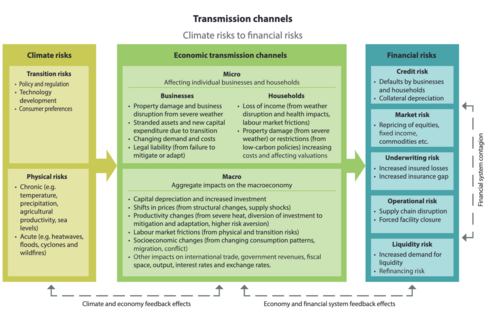

Climate change can affect the financial system through various micro and macro transmission channels (Figure 1).<ref>NGFS Scenarios for central banks and supervisors (2023). https://www.ngfs.net/sites/default/files/medias/documents/ngfs_climate_scenarios_for_central_banks_and_supervisors_phase_iv.pdf </ref> Climate hazards such as wildfires and floods can affect individual businesses and households via directly damaging the property, assets, and means of production. Climate policies and new technologies can influence the profitability of businesses and the wealth of households, creating financial risks for lenders and investors. In addition, climate change can reshape the broader economic environment, indirectly affecting the financial sector. For instance, climate-related policies and regulations may redirect investments, alter the pricing of renewable and traditional energy, and consequently impact the capital valuations of companies holding these assets. | Climate change can affect the financial system through various micro and macro transmission channels (Figure 1).<ref>NGFS Scenarios for central banks and supervisors (2023). https://www.ngfs.net/sites/default/files/medias/documents/ngfs_climate_scenarios_for_central_banks_and_supervisors_phase_iv.pdf </ref> Climate hazards such as wildfires and floods can affect individual businesses and households via directly damaging the property, assets, and means of production. Climate policies and new technologies can influence the profitability of businesses and the wealth of households, creating financial risks for lenders and investors. In addition, climate change can reshape the broader economic environment, indirectly affecting the financial sector. For instance, climate-related policies and regulations may redirect investments, alter the pricing of renewable and traditional energy, and consequently impact the capital valuations of companies holding these assets. | ||

[[File:Transmission_channels|thumb|center| | [[File:Transmission_channels.png|thumb|center|500px|alt=Transmission Channels|Transmission channels of climate risk to financial risk]] | ||

Large-scale climate hazards can also generate significant macroeconomic consequences beyond the immediate area of impact. The direct damage to assets, infrastructure, and production lines in affected regions disrupts productive activities, which can lead to broader economic effects, including reductions in employment, production, and investment, as well as challenges for public finances, such as fiscal revenue losses and debt sustainability concerns. These disturbances can also impair a country’s financial sector, contributing to credit, market, and operational risks, and influencing financial stability indicators. | Large-scale climate hazards can also generate significant macroeconomic consequences beyond the immediate area of impact. The direct damage to assets, infrastructure, and production lines in affected regions disrupts productive activities, which can lead to broader economic effects, including reductions in employment, production, and investment, as well as challenges for public finances, such as fiscal revenue losses and debt sustainability concerns. These disturbances can also impair a country’s financial sector, contributing to credit, market, and operational risks, and influencing financial stability indicators. | ||

Revision as of 18:47, 15 October 2024

Climate change can affect the financial system through various micro and macro transmission channels (Figure 1).[1] Climate hazards such as wildfires and floods can affect individual businesses and households via directly damaging the property, assets, and means of production. Climate policies and new technologies can influence the profitability of businesses and the wealth of households, creating financial risks for lenders and investors. In addition, climate change can reshape the broader economic environment, indirectly affecting the financial sector. For instance, climate-related policies and regulations may redirect investments, alter the pricing of renewable and traditional energy, and consequently impact the capital valuations of companies holding these assets.

Large-scale climate hazards can also generate significant macroeconomic consequences beyond the immediate area of impact. The direct damage to assets, infrastructure, and production lines in affected regions disrupts productive activities, which can lead to broader economic effects, including reductions in employment, production, and investment, as well as challenges for public finances, such as fiscal revenue losses and debt sustainability concerns. These disturbances can also impair a country’s financial sector, contributing to credit, market, and operational risks, and influencing financial stability indicators.

The cascading effects of these disruptions can harm financial performance at multiple levels—across sectors, individual assets, firms, and business lines. As a result, both direct and indirect pathways of risk must be considered for effective financial risk management, even at the firm level. For instance, Bressan et al. (2024)[2] provide an example of firm-level climate financial impact assessment, incorporating both asset-level climate risks and the resulting macroeconomic effects.

References

- ↑ NGFS Scenarios for central banks and supervisors (2023). https://www.ngfs.net/sites/default/files/medias/documents/ngfs_climate_scenarios_for_central_banks_and_supervisors_phase_iv.pdf

- ↑ Bressan, G., Đuranović, A., Monasterolo, I. et al. Asset-level assessment of climate physical risk matters for adaptation finance. Nat Commun 15, 5371 (2024). https://doi.org/10.1038/s41467-024-48820-1