Transition risk: Difference between revisions

| Line 76: | Line 76: | ||

There are various methodologies for assessing transition risk, and the approach chosen depends on how climate scenarios and associated socioeconomic pathways are applied to determine financial risk at the sector and firm level. The methodology must allow for the evaluation of multiple variables and assumptions that affect the economic impact at both the macroeconomic and sectoral levels, as well as enabling the translation of those impacts down to the firm level to estimate the financial consequences for the financial institution involved. | There are various methodologies for assessing transition risk, and the approach chosen depends on how climate scenarios and associated socioeconomic pathways are applied to determine financial risk at the sector and firm level. The methodology must allow for the evaluation of multiple variables and assumptions that affect the economic impact at both the macroeconomic and sectoral levels, as well as enabling the translation of those impacts down to the firm level to estimate the financial consequences for the financial institution involved. | ||

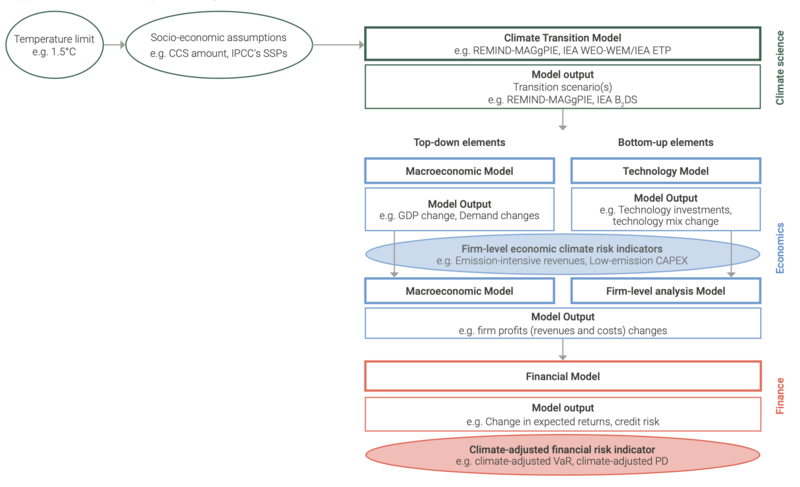

Figure below outlines the structure typically used by transition risk assessment tools. The process usually begins with the selection of a climate scenario, which includes setting a target temperature limit e.g., limiting global warming to 1.5°C. Next, socio-economic assumptions are made to translate the selected temperature limit into developmental parameters, such as assumptions regarding technological advancement, economic growth rates, and energy demand. These assumptions are input into climate-economic models or integrated assessment models (IAMs) to simulate various transition pathways, projecting how changes in regulations, technology, and markets could unfold based on the chosen temperature target. | Figure below outlines the structure typically used by transition risk assessment tools<ref>UNEP FI (2023). The Climate Risk Landscape. Available at: <nowiki>https://www.unepfi.org/themes/climate-change/2023-climate-risk-landscape/</nowiki></ref>. The process usually begins with the selection of a climate scenario, which includes setting a target temperature limit e.g., limiting global warming to 1.5°C. Next, socio-economic assumptions are made to translate the selected temperature limit into developmental parameters, such as assumptions regarding technological advancement, economic growth rates, and energy demand. These assumptions are input into climate-economic models or integrated assessment models (IAMs) to simulate various transition pathways, projecting how changes in regulations, technology, and markets could unfold based on the chosen temperature target. | ||

[[File:schematic_transition_risk.png|thumb|center|800px|alt=Example Analysis Structure of Transition Risk(Source: UNEP(2023))]] | [[File:schematic_transition_risk.png|thumb|center|800px|alt=Example Analysis Structure of Transition Risk(Source: UNEP(2023))|(Source: UNEP (2023))]] | ||

The output of the climate-economic model or integrated assessment model is then fed into an economic model (which could have a top-down or bottom-up design, or a combination of both) to estimate the broader economic impacts of different transition scenarios. These outputs often include changes in GDP or technology investments. The results from the economic model are then combined with firm-level risk indicators such as emissions-intensive revenues or low-emissions capital expenditures to enable a firm-level risk assessment. The output describes a firm’s risk profile in terms of revenues and costs changes. | The output of the climate-economic model or integrated assessment model is then fed into an economic model (which could have a top-down or bottom-up design, or a combination of both) to estimate the broader economic impacts of different transition scenarios. These outputs often include changes in GDP or technology investments. The results from the economic model are then combined with firm-level risk indicators such as emissions-intensive revenues or low-emissions capital expenditures to enable a firm-level risk assessment. The output describes a firm’s risk profile in terms of revenues and costs changes. | ||

In order to be integrated into financial models for traditional financial risk assessment, such as credit risk assessment, more metrics, such as climate value-at-risk (VaR) or a firm’s climate-adjusted probability of default may be calculated. | In order to be integrated into financial models for traditional financial risk assessment, such as credit risk assessment, more metrics, such as climate value-at-risk (VaR) or a firm’s climate-adjusted probability of default may be calculated. | ||

Revision as of 13:08, 16 October 2024

Introduction

Transition risks are those associated with the pace and extent at which an organization manages and adapts to the internal and external pace of change to reduce greenhouse gas emissions and transition to renewable energy. Transitioning requires policy and legal, technology, and market changes to address mitigation and adaptation requirements related to climate change (see Table 1). Depending on the nature, speed, and focus of these changes, transition risks may pose varying levels of financial and reputational risk to organizations (see Table 2). Alternatively, if an organization is a low-carbon emitter and in the renewable energy or climate transition market, they could experience market, technological, and reputational opportunities.

| Transition Risk Categories | |

|---|---|

| Policy and Legal | Policy actions around climate change continue to evolve. Their objectives generally fall into two categories—policy actions that attempt to constrain actions that contribute to the adverse effects of climate change or policy actions that seek to promote adaptation to climate change. The risk associated with and financial impact of policy changes depend on the nature and timing of the policy change. As the value of loss and damage arising from climate change grows, litigation risk is also likely to increase. Reasons for such litigation include the failure of organizations to mitigate impacts of climate change, failure to adapt to climate change, and the insufficiency of disclosure around material financial risk my s. |

| Technology | Technological improvements or innovations that support the transition to a lower-carbon, energy efficient economic system can have a significant impact on organizations. To the extent that new technology displaces old systems and disrupts some parts of the existing economic system, winners and losers will emerge from this "creative destruction" process. The timing of technology development and deployment, however, is a key uncertainty in assessing technology risk. |

| Market | While the ways in which markets could be affected by climate change are varied and complex, one of the major ways is through shifts in supply and demand for certain commodities, products, and services as climate-related risks and opportunities are increasingly considered. |

| Reputation | Climate change has been identified as a potential source of reputational risk tied to changing customer or community perceptions of an organization's contribution to or detraction from the transition to a lower-carbon economy. |

Source: This table's content is reproduced from Recommendations of the Task Force on Climate-related Financial Disclosures

| Climate-related Transition Risks | Potential Financial Impacts |

|---|---|

| Policy and Legal | |

|

|

| Technology | |

|

|

| Market | |

|

|

| Reputation | |

|

|

Source: This table's content is reproduced from Recommendations of the Task Force on Climate-related Financial Disclosures

Assessment Methodology

There are various methodologies for assessing transition risk, and the approach chosen depends on how climate scenarios and associated socioeconomic pathways are applied to determine financial risk at the sector and firm level. The methodology must allow for the evaluation of multiple variables and assumptions that affect the economic impact at both the macroeconomic and sectoral levels, as well as enabling the translation of those impacts down to the firm level to estimate the financial consequences for the financial institution involved.

Figure below outlines the structure typically used by transition risk assessment tools[1]. The process usually begins with the selection of a climate scenario, which includes setting a target temperature limit e.g., limiting global warming to 1.5°C. Next, socio-economic assumptions are made to translate the selected temperature limit into developmental parameters, such as assumptions regarding technological advancement, economic growth rates, and energy demand. These assumptions are input into climate-economic models or integrated assessment models (IAMs) to simulate various transition pathways, projecting how changes in regulations, technology, and markets could unfold based on the chosen temperature target.

The output of the climate-economic model or integrated assessment model is then fed into an economic model (which could have a top-down or bottom-up design, or a combination of both) to estimate the broader economic impacts of different transition scenarios. These outputs often include changes in GDP or technology investments. The results from the economic model are then combined with firm-level risk indicators such as emissions-intensive revenues or low-emissions capital expenditures to enable a firm-level risk assessment. The output describes a firm’s risk profile in terms of revenues and costs changes.

In order to be integrated into financial models for traditional financial risk assessment, such as credit risk assessment, more metrics, such as climate value-at-risk (VaR) or a firm’s climate-adjusted probability of default may be calculated.

- ↑ UNEP FI (2023). The Climate Risk Landscape. Available at: https://www.unepfi.org/themes/climate-change/2023-climate-risk-landscape/