Open-source Tools for Physical Risk Analysis: Difference between revisions

Jump to navigation

Jump to search

| Line 6: | Line 6: | ||

=== Macroeconomic models === | === Macroeconomic models === | ||

{| class="wikitable" | {| class="wikitable" | ||

|+Table 1 Types of Economic Models to Assess Climate Risks (reproduced from NGFS (2020)<ref>NGFS, 2020: Guide to climate scenario analysis for central banks and supervisors.</ref>) | |+Table 1 Types of Economic Models to Assess Climate Risks (reproduced from NGFS (2020)<ref name=":0">NGFS, 2020: Guide to climate scenario analysis for central banks and supervisors.</ref>) | ||

!Lineage | !Lineage | ||

!Model Type | !Model Type | ||

| Line 72: | Line 72: | ||

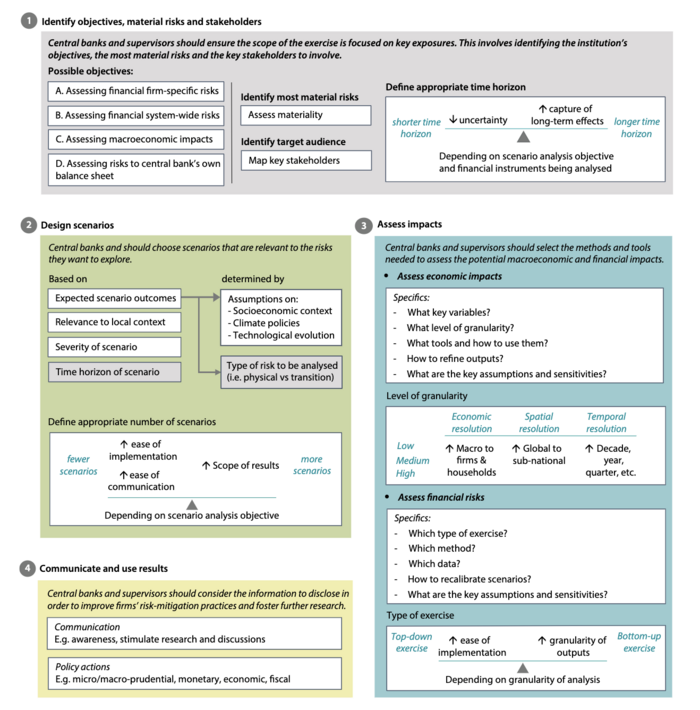

* The [https://www.ngfs.net/ngfs-scenarios-portal/use/ NGFS Climate Scenarios Portal] provides a comprehensive suite of data and tools to analyze transition risks, physical risks, and their broader economic and financial impacts. This was created for central banks and financial supervisors but has been reported useful for private sectors. This resource is widely recognized and used by key regulatory bodies, including the Basel Committee on Banking Supervision<ref>Basel Committee on Banking Supervision (BCBS), 2022. Principles for the effective management and supervision of climate‐related financial risks.</ref> and European Central Bank<ref>Alogoskoufis, Spyros, et al. ''ECB economy-wide climate stress test: Methodology and results''. No. 281. ECB Occasional Paper, 2021.</ref>. Figure 1 below shows an overview of the scenario analysis process using the NGFS portal. | * The [https://www.ngfs.net/ngfs-scenarios-portal/use/ NGFS Climate Scenarios Portal] provides a comprehensive suite of data and tools to analyze transition risks, physical risks, and their broader economic and financial impacts. This was created for central banks and financial supervisors but has been reported useful for private sectors. This resource is widely recognized and used by key regulatory bodies, including the Basel Committee on Banking Supervision<ref>Basel Committee on Banking Supervision (BCBS), 2022. Principles for the effective management and supervision of climate‐related financial risks.</ref> and European Central Bank<ref>Alogoskoufis, Spyros, et al. ''ECB economy-wide climate stress test: Methodology and results''. No. 281. ECB Occasional Paper, 2021.</ref>. Figure 1 below shows an overview of the scenario analysis process using the NGFS portal. | ||

[[File:scenario_analysis_process.png|thumb|center|700px|alt=Transmission Channels|Overview of the Scenario Analysis Process (Source: NGFS ( | [[File:scenario_analysis_process.png|thumb|center|700px|alt=Transmission Channels|Overview of the Scenario Analysis Process (Source: NGFS (2020)<ref name=":0" />)]] | ||

* | * | ||

* | * | ||

Revision as of 16:41, 23 October 2024

Catastrophe models

- CLIMADA: An open-source risk assessment model developed by ETH Zurich.[1] It uses probalistic modelling to estimate the expected economic damage as a measure of risk today. The model is well suited to provide an open and independent view on physical risk, in line with TCFD and underpins the Economics of Climate Adaptation (ECA) approach. As of today, it provides global coverage of major climate-related extreme-weather hazards (tropical cyclones, river flood, agro drought, and European winter storms) at high resolution (4km) for historic and some selected climate forcing scenarios (RCPs). Also see the introduction by European Environment Agency.

- The Oasis Loss Modelling Framework ("LMF"): an open source catastrophe modeling platform. It developed by a nonprofit organization funded and owned by the Insurance Industry to promote open access to models and to promote transparency. Additionally, some firms within the insurance industry are currently working with the Association for Cooperative Operations Research and Development (ACORD) to develop an industry standard for collecting and sharing exposure data.

- An open-source tools for the modelling and management of climate change risks is developed using CLIMADA by European Insurance and Occupational Pensions Authority (EIOPA)

Macroeconomic models

| Lineage | Model Type | Description | Example |

|---|---|---|---|

| Integrated climate-economy

models |

Cost-benefit IAMs | Highly aggregated model that optimises welfare by determining emissions abatement at each step | DICE, DSICE (Cai et al., 2012[3], Barrage, 2020[4]) |

| IAMs with detailed energy system and land use | Detailed partial (PE) or general equilibrium (GE) models of the energy system and land use. General equilibrium types are linked to a simple growth model | PE: GCAM, IMAGE GE: MESSAGE, REMIND-MAgPIE, WITCH[5] | |

| Computable General Equilibrium (CGE) IAMs | Multi-sector and region equilibrium models based on optimising behaviour assumptions | G-CUBED, AIM, MIT-EPPA, GTAP, GEM-E3 | |

| Macro-econometric IAMs | Multi-sector and region model similar to CGE but econometrically calibrated | E3ME, Mercure et al., 2018[6] | |

| Stock-flow consistent IAMs | Highly aggregated model of climate change and the monetary economy that is stock-flow consistent | Bovari et al., 2018[7] | |

| Other climate-economy models | Input-output (IO) models | Model that tracks interdependencies between different sectors to more fully assess impacts | Ju and Chen, 2010[8]

Koks and Thissen, 2016[9] |

| Econometric studies | Studies assessing impact of physical risks on macroeconomic variables (e.g. GDP, labour productivity) based on historical relationships | Kahn et al., 2019[10] | |

| Natural catastrophe models and micro-empirical studies | Spatially granular models and studies assessing bottom-up damages from physical risks | SEAGLASS (e.g. Hsiang et al., 2017[13]) | |

| Modified standard macroeconomic models | DSGE models | Dynamic equilibrium models based on optimal decision rules of rational economic agents | Golosov et al., 2014[14]

Cantelmo et al. 2019[15] |

| E-DSGE | Slightly modified standard frameworks (that allow for negative production externalities) | Heutel, 2012[16] | |

| Large-scale econometric models | Models with dynamic equations to represent demand and supply, coefficients based

on regressions |

NiGEM (e.g. Vermeulen et al., 2018[17]) |

- For further guidance on selecting appropriate macroeconomic models, see the recommendations on page 29.

NGFS Scenarios Portal

- The NGFS Climate Scenarios Portal provides a comprehensive suite of data and tools to analyze transition risks, physical risks, and their broader economic and financial impacts. This was created for central banks and financial supervisors but has been reported useful for private sectors. This resource is widely recognized and used by key regulatory bodies, including the Basel Committee on Banking Supervision[18] and European Central Bank[19]. Figure 1 below shows an overview of the scenario analysis process using the NGFS portal.

Others

- Physical Risk Toolkit by C2ES This toolkit helps companies identify data and information providers for conducting physical climate risk assessments, focusing on US-based publicly available federal and academic resources. It includes some tools from private organizations but does not endorse them. The toolkit mainly serves as a starting point for further analysis.

References

- ↑ ETHZürich, “CLIMADA: Economics of Climate Adaptation,” https://wcr.ethz.ch/research/climada.html.

- ↑ Jump up to: 2.0 2.1 NGFS, 2020: Guide to climate scenario analysis for central banks and supervisors.

- ↑ Cai, Y., Judd, K. L., & Lontzek, T. S. (2012) DSICE: a dynamic stochastic integrated model of climate and economy. RDCEP Working Paper 12-02.

- ↑ Barrage, L. (2020) Optimal Dynamic Carbon Taxes in a Climate–Economy Model with Distortionary Fiscal Policy. The Review of Economic Studies, 87(1), 1-39.

- ↑ Model documentation available at www.iamcdocumentation.eu/index.php/IAMC_wiki

- ↑ Mercure, J. F., Pollitt, H., Viñuales, J. E., Edwards, N. R., Holden, P. B., Chewpreecha, U., ... & Knobloch, F. (2018) Macroeconomic impact of stranded fossil fuel assets. Nature Climate Change, 8(7), 588-593.

- ↑ Bovari, E., Giraud, G., & Mc Isaac, F. (2018) Coping with collapse: a stock-flow consistent monetary macrodynamics of global warming. Ecological Economics, 147, 383-398.

- ↑ Ju, L. & Chen, B. (2010) An input-output model to analyse sector linkages and CO2 emissions. Procedia Environmental Sciences, 2, 1841-1845.

- ↑ Koks, E. E., & Thissen, M. (2016) A multiregional impact assessment model for disaster analysis. Economic Systems Research, 28(4), 429-449.

- ↑ Kahn, M. E., Mohaddes, K., Ng, R. N., Pesaran, M. H., Raissi, M., & Yang, J. C. (2019) Long-term macroeconomic effects of climate change: A cross-country analysis (No. w26167). National Bureau of Economic Research.

- ↑ Burke, M., Hsiang, S. M., & Miguel, E. (2015) Global non-linear effect of temperature on economic production. Nature, 527(7577), 235-239.

- ↑ Dell, M., Jones, B. F., & Olken, B. A. (2012) Temperature shocks and economic growth: Evidence from the last half century. American Economic Journal: Macroeconomics, 4(3), 66-95.

- ↑ Hsiang, S., Kopp, R., Jina, A., Rising, J., Delgado, M., Mohan, S., ... & Larsen, K. (2017) Estimating economic damage from climate change in the United States. Science, 356(6345), 1362-1369.

- ↑ Golosov, M., Hassler, J., Krusell, P., & Tsyvinski, A. (2014) Optimal taxes on fossil fuel in general equilibrium. Econometrica, 82(1), 41-88.

- ↑ Cantelmo, M. A., Melina, M. G., & Papageorgiou, M. C. (2019) Macroeconomic Outcomes in Disaster-Prone Countries. International Monetary Fund, Working Paper No.19/217, October 2019.

- ↑ Heutel, G. (2012) How should environmental policy respond to business cycles? Optimal policy under persistent productivity shocks. Review of Economic Dynamics, 15(2), 244-264.

- ↑ Vermeulen, R., Schets, E., Lohuis, M., Kolbl, B., Jansen, D. J., & Heeringa, W. (2018) An energy transition risk stress test for the financial system of the Netherlands. DNB Occasional Studies, 160-7.

- ↑ Basel Committee on Banking Supervision (BCBS), 2022. Principles for the effective management and supervision of climate‐related financial risks.

- ↑ Alogoskoufis, Spyros, et al. ECB economy-wide climate stress test: Methodology and results. No. 281. ECB Occasional Paper, 2021.